Wadih Pazos

Wadih founded both PairSoft and PaperSave. He is an avid technologist who specializes in streamlining operations and maximizing productivity.

View all posts by Wadih PazosWadih Pazos

Investopedia recommended jumping on board due to research conducted by Goldman Sachs that projects software-as-a-service (SaaS) revenue to reach $106 in 2016 – a 21 percent increase over this year’s figures. According to a Forrester study, the source reported that cloud computing as an industry is expected to grow from $58 billion in 2013 to about $191 million by 2020, meaning now would be an opportune time to invest.

According to the Goldman Sachs study, Enterprise Irregulars added that spending on cloud computing infrastructure and platforms is projected to see continued growth. The compound annual growth rate between 2013 and 2018 will likely be an astounding 30 percent, while the rest of the IT field will only see a 5 percent CAGR over the same period.

The reasons behind the expansion of cloud computing can be tied to a few very simple factors, Investopedia elaborated. The ability to outsource software and hardware used for tech services is a major cost-cutting initiative. At the same time, clients also benefit by not having to buy resources they can now obtain from on-demand cloud services.

IT executives listed security, cloud computing, and mobile devices as their top three priorities for the next 12 months, Enterprise Irregulars noted. Remarkably, 42 percent of all industry decision-makers have plans to increase spending on cloud computing during this period, and for companies with over 1,000 employees, that rate rises to 52 percent.

So, it’s clear that the industry is constantly growing and seems well-positioned to continue to do so for the better part of the next half-decade, at the very least. From an investing perspective, now would appear to be a good time to get involved to maximize ROI best. As for businesses – if you haven’t made the switch to cloud-based documenting and transactions, it’s probably a wise idea to do so. The future will be centered around mobile trade, and being aggressive in keeping up with the latest technology and software trends is imperative for success.

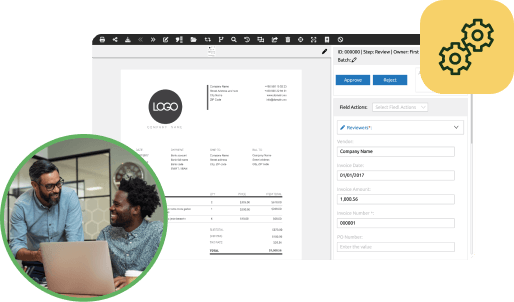

Get a free demo to learn how our tailored workflows have boosted the AP performance for organizations of all sizes.

Many organizations start with manual receipt handling, fragmented card feeds and slow AP processes. Implement AI agents to auto-capture receipts, route approvals, enable punch-out buys and post to the ERP.

Result: faster batching, fewer errors and cost savings. “This saves us hours every month.”

Many organizations face slow, paper-heavy AP and fragmented procurement that waste time and inflate costs. AI Agents can automate approvals, PO matching and record sync to improve speed, accuracy and control. Client quote: “It freed up hours and made our process reliable.”

Operational drag and rising costs slow growth: teams waste time on manual tasks, misaligned priorities and opaque processes. AI Agents help automate routine work and coordinate actions across teams. “We’ve lost time to repeats and handoffs,” says a typical client.

Companies struggle with manual procurement, fragmented approvals, and costly integrations that slow growth and obscure spend. Our AI Agents streamline requisitions, POs, and invoice matching to cut manual work and improve visibility. “We were wasting time and missing insights,” says a client.

Many teams start with fragmented PO/AP systems, manual matching and delayed financial reporting. Deploying AI agents to automate PO checks, real-time encumbrance tracking and invoice matching reduces processing time and errors, delivering live budgets and faster closes. “Finally, we can see current balances and approve instantly.”

Many companies juggle growing invoice volumes and legacy systems. They struggle with manual processes, compliance gaps and limited headcount. Our AI Agents automate integrations, enforce rules and surface exceptions. The typical outcome: faster closes and measurable ROI. “We stopped chasing invoices.”