Automating an AP process is performed with software that simplifies invoice capture, extracts relevant details, matches these details to purchasing and receiving documents, and automatically routes invoices for approval and payment.

Janet Martin

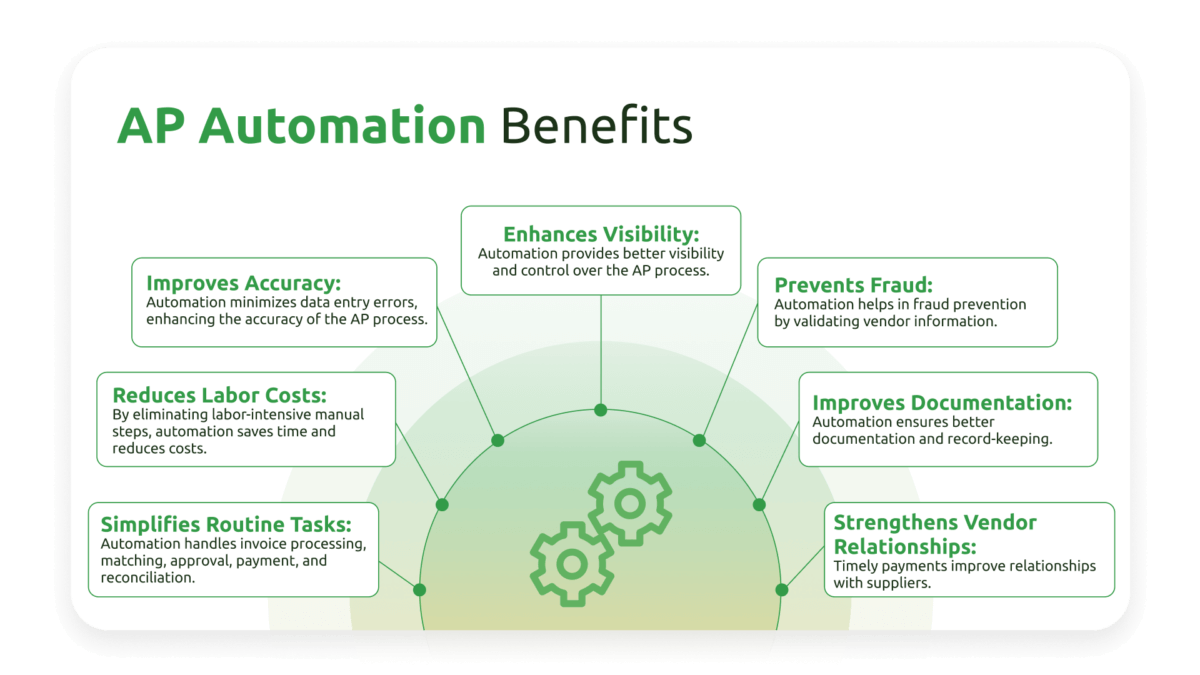

Every business has bills to pay, and manually processing supplier invoices can be time-consuming, labor-intensive, and prone to errors, driving up operating costs. Automating accounts payable (AP) workflows simplifies these routine tasks, reduces costs, and improves accuracy, while providing businesses with greater control over the procure-to-pay cycle. With the recent integration of AI-powered components like PairSoft’s AI-driven general ledger (GL) coding, automation is reaching new levels of efficiency, further streamlining financial processes.

AP automation boosts operating efficiency, helps manage cash flow, and frees staff to focus on more strategic work by eliminating manual tasks such as entering, reviewing, approving, and paying vendor invoices. In an automated AP workflow, many of the steps are completed using software instead of manual labor, starting from the receipt of a vendor bill to payment and reconciliation. These steps include processing electronic invoices, entering bill details, matching invoices to purchase orders and receiving documents, approving and paying invoices, and reconciling transactions. With the addition of AI to processes like GL coding, businesses can now achieve even greater accuracy and speed in categorizing expenses, leading to enhanced financial clarity and control.

Automating the AP workflow delivers several key advantages:

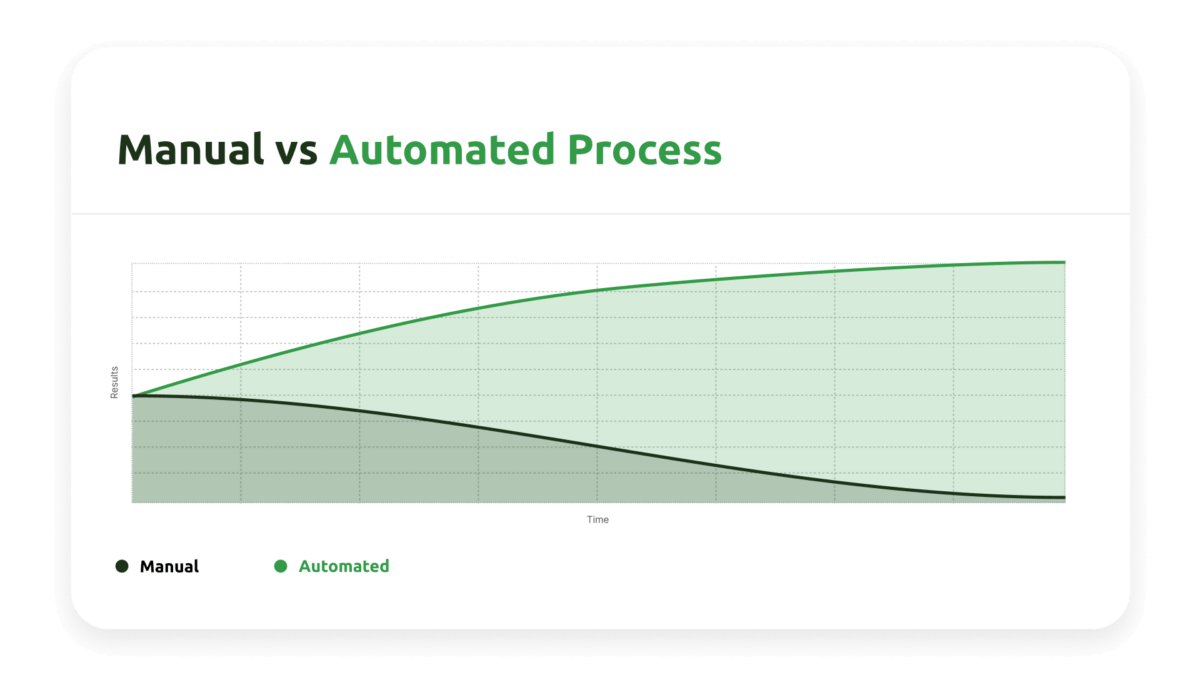

An AP workflow is a series of steps a business follows to complete tasks such as invoice processing. Traditionally, this involves receiving invoices, entering them into accounting systems, matching them against purchase orders, and approving payments. However, manual workflows are time-consuming and prone to errors, while automated workflows are efficient, timely, and accurate.

A significant new feature of PairSoft’s AP automation is its AI-driven general ledger coding. This AI component learns from past transactions and automatically categorizes expenses, reducing manual coding efforts and ensuring that all entries align with business rules. This level of automation ensures that invoices are accurately mapped to the correct expense categories, dramatically reducing the chance for misclassifications that can skew financial reports.

Invoice Processing

Many companies receive the bulk of their invoices electronically. Bills can be imported into the system via drag and drop, avoiding the need for manual data entry.

Data Extraction

Using scan and capture technologies like optical character recognition (OCR), AP software extracts key information from the invoice, such as items and quantity ordered, unit pricing and totals, PO number, and vendor details.

AI-Powered GL Coding

AI learns from historical data to categorize transactions with high precision, ensuring consistency and improving financial reporting accuracy.

Document Matching

The software performs a two-way or three-way match to check that the invoice matches the original purchase order and, in the case of goods and materials, associated receiving documents. If there’s a mismatch in any of these documents, the software flags the invoice for further review.

Routing and Approval

The AP automation software routes the invoice to the appropriate manager or department for review and approval.

Touchless Payment

In some cases, companies may choose to approve low-risk, low-value invoices automatically based on preset thresholds. For example, invoices under $500 might be paid automatically, while invoices above that amount would require approval. Recurring invoices like utility bills might be paid automatically as long as the total falls within a specified range.

Payment Authorization and Execution

If reviewer approval is necessary, the AP software tags an authorized member of the AP team to quickly review and approve the payment.

Vendor Communication

The AP system can automatically inform vendors when payments are made and by what method so they know when funds should be available. For instance, it may tell suppliers that payment will be made via ACH to their bank account within 48 hours. Some systems have intuitive portals that vendors can access to view the status of payments.

Record-Keeping and Reconciliation

Automated AP systems track invoices throughout the entire AP process, meaning that you will always have an accurate record in the event of a payment dispute or an audit. They facilitate reconciliation to verify that the internal documentation of payment matches external bank records.

AI and machine learning are transforming the AP automation landscape. The inclusion of AI for GL coding offers numerous benefits:

How AP Automation Works

Accounts payable automation creates a digital workflow that handles routine steps in the AP process, helping companies boost productivity, reduce costs, and increase accuracy.

AP Automation Workflow Steps

The AP automation workflow handles multiple AP steps, from receiving invoices to approving and paying them. When an invoice is received, software automatically extracts the data using optical character recognition (OCR), categorizes the invoice, and creates appropriately coded general ledger entries. The software also performs three-way matching — checking the validity of the invoice against purchase orders and receipts for the goods/services provided. Any exceptions or apparent errors can be flagged for manual review. The software routes invoices for approval, or it can be customized to pay approved invoices that meet certain conditions, such as invoice amounts below a preset threshold.

Higher Productivity

AP automation reduces manual accounting chores, helping to greatly increase AP productivity. One WorkMarket survey found that more than 60% of businesses are already automating some accounting tasks or are planning to do so — and they listed productivity increases as one of the top reasons for applying automation.

Greater Accuracy

AP automation minimizes the risk of errors throughout the AP process by limiting manual data entry, which can cause problems such as mistyping invoice data or incorrect coding. It also cross-checks invoice accuracy by automatically matching invoices against purchase orders and receiving documents.

Lower Costs

AP automation reduces costs by improving productivity, and it also helps companies pay invoices on time — which means a lower risk of late-payment penalties.

Increased Visibility

Managers can monitor the progress of any invoice as it moves through the AP pipeline. They can also track efficiency and productivity metrics for the AP team.

Fraud Prevention

A well-implemented AP automation workflow can help companies detect fraud and avoid erroneous payments by validating vendor information and flagging unusual or anomalous payment requests for review.

Supplier Discounts

By ensuring that all invoices get paid quickly, AP automation can help companies win early payment discounts from their suppliers.

Better Records

All information is managed and stored centrally; businesses don’t need to hunt through stacks of old documents to track down information about old invoices and payments. In the case of an audit,

software makes sure that the required information is available when needed.

Common Issues in AP Automation Implementation

Solutions to AP Automation Challenges

When selecting AP automation software, consider:

Integration is crucial for the success of AP automation. Ensure that the chosen software can:

Proper training is essential to maximize the benefits of AP automation. Training should cover:

AI and Machine Learning in AP Automation

AP automation software uses AI and machine learning to automatically process and categorize invoices according to your business’s needs. This technology can learn from past transactions to improve accuracy and efficiency over time.

Real-Time Dashboards

Real-time dashboards provide instant access to key performance indicators and accounts payable information. Managers can monitor AP aging, invoices awaiting approval, and payments in progress at a glance.

Customizable Workflows

Customizable workflows allow businesses to tailor the AP process to their specific needs. This flexibility ensures that the automation system aligns with existing business practices and requirements.

Emerging Technologies in AP Automation

Predictions for the Future of AP Automation

Automating your AP workflows plays a crucial role in increasing operating efficiency. It helps businesses reduce costs, process invoices faster, and minimize errors, while providing greater control and visibility into the overall AP process.

Automating an AP process is performed with software that simplifies invoice capture, extracts relevant details, matches these details to purchasing and receiving documents, and automatically routes invoices for approval and payment.

An automation workflow is a set of steps that is carried out automatically by software to complete a task. It replaces a set of manual steps. For accounts payable, an automation workflow can include scanning, uploading, and verifying invoices, routing for approval, and automatic payment of low-risk, low-value invoices.

AP automation involves creating a digital workflow for the steps involved in receiving, approving, paying, and recording invoices.

AP automation software uses artificial intelligence to automatically process and categorize invoices according to your business’s needs.

Full Cycle AP is a term for the entire process that begins when a product or service is obtained and ends when the invoice is paid. For example, the full cycle for an order of office supplies begins when the order is placed and ends when the completed payment is reconciled with the bank or credit card statement.

General ledger codes are numbers assigned to general ledger accounts and used to categorize transactions. For example, all electrical utility bills might be assigned the same GL code. GL codes make it easier to classify and analyze revenue and spending.

Get a free demo to learn how our tailored workflows have boosted the AP performance for organizations of all sizes.