Salim Khalife

Salim Khalife founded Paramount Workplace, now a subsidiary of PairSoft. He currently uses his decades of SaaS experience in the consulting space and is based out of Michigan with his family.

View all posts by Salim KhalifeSalim Khalife

AP automation software is a software add-on that automates the accounts payable process, from invoice receipt to payment process. This includes capturing data from invoices and vendor bills, routing them through an approval process, and facilitating payments to vendors. By automating these tasks — especially through their NetSuite ERP — AP teams can reduce errors, maintain on-demand audit trails, improve efficiency, and gain better visibility into their financial operations.

Oracle NetSuite is a cloud-based ERP system that provides a single, integrated solution for managing financial, operational, and customer-facing processes. Integrating an AP automation solution with NetSuite can significantly improve the invoice management speed of a business. With AP automation, invoices can be processed and approved more quickly, reducing the time it takes to make payment reconciliation with vendors. Automation can also reduce mistakes and rework associated with error-prone manual processes, leading to faster invoice processing times. By integrating AP automation with their ERP, NetSuite customers can further streamline their financial workflows, reducing processing times and improving cash flow.

In addition to faster invoice processing, businesses can also gain better analytics on their accounts payable by integrating certain modules and functionality within their setup. With real-time visibility into the status of supplier invoices and payment options, businesses can track performance and identify areas for improvement. The integration of accounts payable APIs with NetSuite can also provide deeper insights into vendor spending patterns, invoice processing times, and payment methods. These insights can help businesses optimize their NetSuite accounts payable processes, reduce costs, and improve their overall financial performance.

By integrating AP automation with NetSuite, companies can further streamline their financial workflows and gain additional benefits, including:

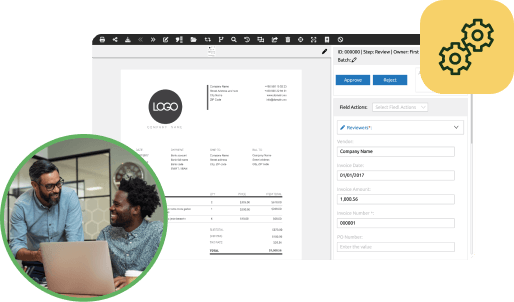

NetSuite AP automation eliminates manual data entry and routing, often through OCR (Optical Character Recognition) data capture, freeing up finance teams to focus on more strategic tasks. With NetSuite integration, invoice capture can be automatically matched to purchase orders, routed for approval, and recorded in the document management system for rapid retrieval and searchability. This reduces the time and effort required for invoice processing and speeds up the procure-to-pay cycle.

Manual data entry is prone to errors, and mistakes can be costly for businesses. By automating the AP process, companies can reduce errors and improve accuracy. With NetSuite integration, data from invoices can be automatically captured and entered into the system for PO matching, reducing the risk of typos and other data entry errors.

AP automation provides real-time visibility into the status of invoices and payments, allowing finance teams to track performance and identify procurement bottlenecks. With NetSuite integration, this visibility extends to the entire financial system, enabling companies to gain a holistic view of their financial operations and general ledger.

By reducing manual tasks and errors, AP automation can save companies time and money. In addition, automation can help companies capture early payment discounts (through virtual credit card rebates, waived ACH fees, etc.) and avoid late payment fees. With NetSuite integration, companies can further optimize their financial operations, reducing costs and improving their bottom line.

Regulatory compliance is critical for businesses, and failure to comply can result in costly fines and reputational damage. With AP automation and NetSuite integration, companies can ensure compliance with regulations such as Sarbanes-Oxley (SOX) and the General Data Protection Regulation (GDPR). Automated workflows ensure that invoices are processed and approved according to company policies and regulatory requirements, reducing the risk of non-compliance.

Accounts payable (AP) automation can be a game-changer for businesses looking to scale their operations. As businesses grow, so do their financial operations, and manual processes can quickly become cumbersome and time-consuming. AP automation can help businesses scale their accounts payable processes more easily and efficiently by eliminating manual data entry and automating approval workflows. With AP automation, businesses can process more invoices in less time, reducing the need for additional resources and headcount as they grow. Additionally, AP automation can provide real-time visibility into invoice processing times, payment trends, and vendor spending patterns, enabling businesses to optimize their processes and adapt to changing market conditions. By integrating AP automation with their existing systems, such as NetSuite, businesses can scale their operations more effectively and stay ahead of the competition.

Accounts payable automation is a powerful tool for streamlining financial operations and improving performance. When integrated with NetSuite, it can transform finance departments into top performers for their sector. By increasing efficiency, improving accuracy, providing better visibility, saving costs, ensuring compliance, and enabling scalability, AP automation and NetSuite integration can help businesses optimize their financial operations and achieve their strategic objectives.

Looking to get the most out of your NetSuite setup? Get a demo today on our natively integrated NetSuite solution for AP automation and document management — no extra licenses required.

Get a free demo to learn how our tailored workflows have boosted the AP performance for organizations of all sizes.